ADP WOTC

About ADP

For over 75 years, ADP has served as a trusted human resources, payroll and benefits partner to employers around the world, and for 30+ years provided tax credit capture and expertise. Our mission is to provide insightful solutions that drive value and success for our clients by allowing them to focus on their business. Today, we serve approximately 1 million clients in 140 countries, ranging from small start-up businesses with a handful of employees, to large, multinational companies with thousands of employees spanning the globe.

Jobvite by Flexspring Connector for ADP SmartCompliance(R) Tax Credits Screening

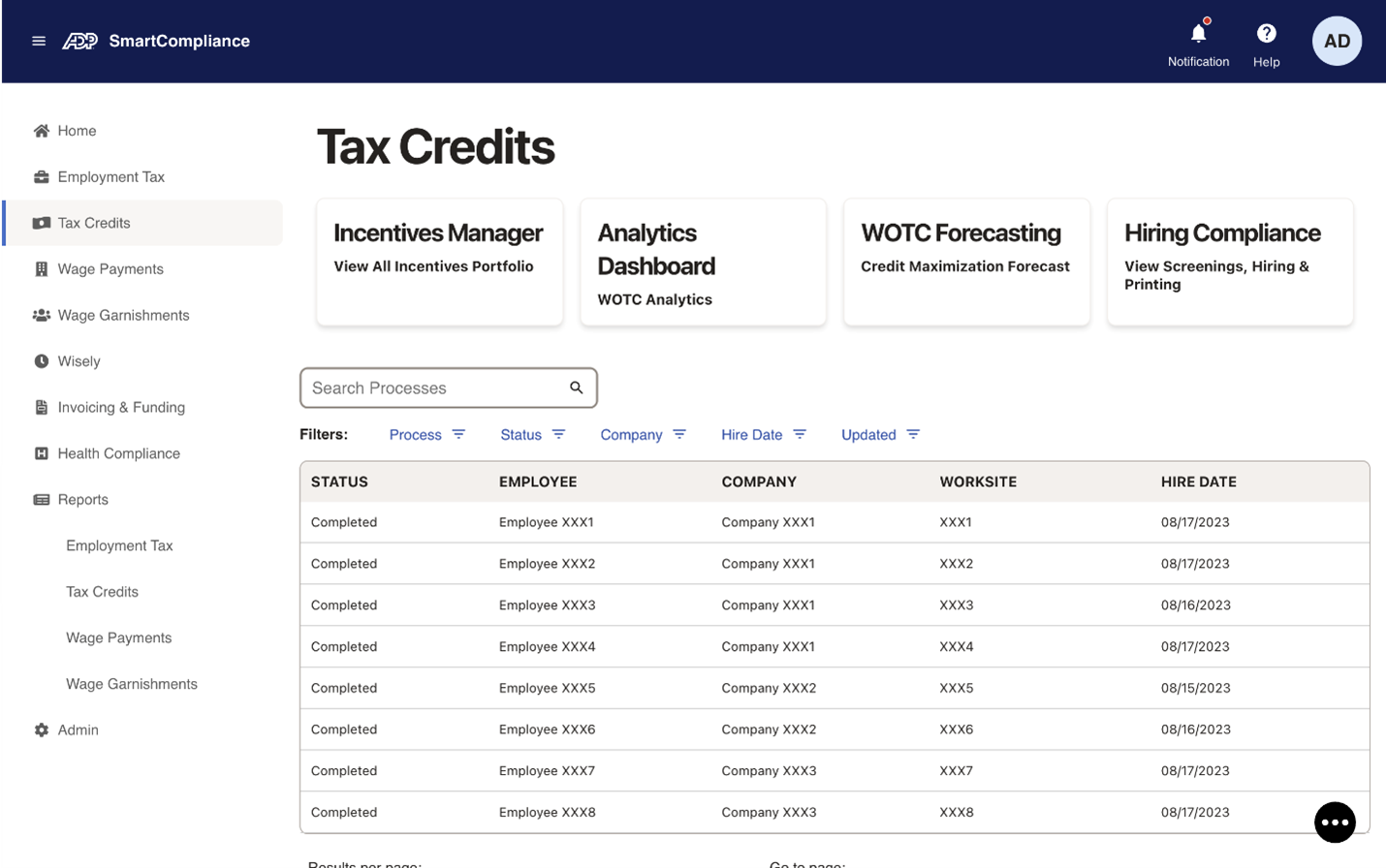

Compliance-focused, secure and automated integration for data to identify, maximize and secure applicable tax credits:

- Simple and easy implementation

- Automated and recurring integration

- API or file-based options based on best practices

- Minimal ongoing maintenance required

Top 3 benefits of integration with ADP SmartCompliance® Tax Credits:

- Identify, maximize and secure tax credit and incentive opportunities, regardless of ERP, ATS, HCM or third-party systems in place

- Help lower your effective tax rate and create budget justifications

- Leverage a full suite of credits: Work Opportunity Tax Credits (WOTC), points of hire, geographic training, negotiated, federal empowerment zones, research & development (R&D) and more